Just about 5 trading days ago, the Dow Jones & S&P500 looked like tanking at least another 10% with tweets by Trump on escalating the trade wars once again. Within two days, the cloud clears up and with market was set free to climb trying to reach the all-time highs.

At this stage, we get a ‘weird optimism’ feeling somewhat similar to when someone tells you that “everything is going to be alright” but you are pretty sure it’s not.

Prior to the drop that we converted much of our positions back to cash & locking in profits that we made earlier. What’s left would be positions in the Hong Kong market where we consider that it is trading at a big discount versus other majors. For obvious reason, we believed that the market had corrected in response to the city’s rising tension. Our exposure there isn’t quite Hong Kong companies in generally, but mainly the Chinese H-shares which we felt cheap and has a re-rating potential.

Comparing with the Malaysian market, our optimism dropped significantly after lackluster a Budget 2020 prospects and even a mulling on a possibility of a recession in the US that could possibly cause a worldwide spread. Most of the counters who moved up had some relations to the US market for example OEM or machine makers for the multinational corporations (MNC) situated specifically in Penang. We believe as well these had been fully valued for now.

The oil sector sees huge growth this year, but too bad we didn’t cover most of it other than our heavy holding in Serba Dinamik. But one must understand that the growth seen on the oil sector this year came from the contribution of oil price climbing to the $70-80s back in 2018. Contracts were awarded then and as we see the prices cool off once again this year, we can expect less CAPEX to come from the major oil companies, translating into lower share prices in the future.

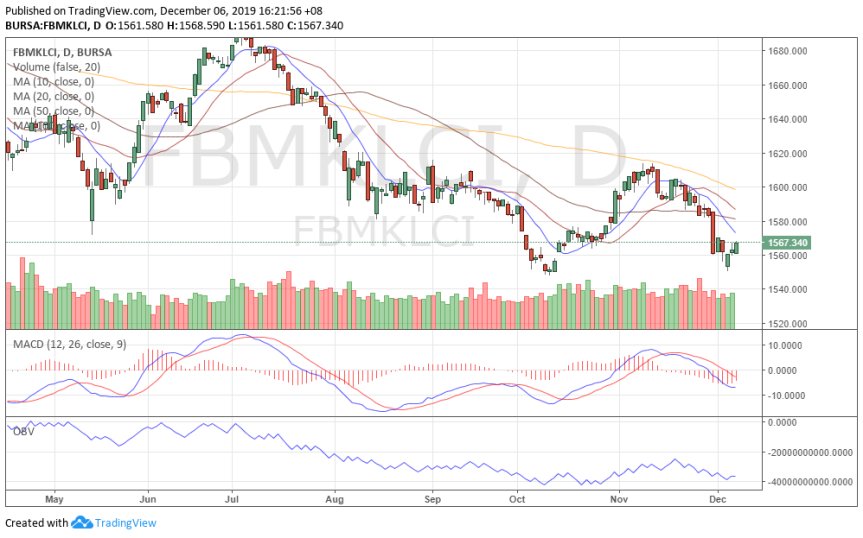

Already seeing KLCI trading with a double bottom nearing 1,550, it’s pretty clear how investors felt on the development for Malaysia going forward. The heavy weights of KLCI with the likes of banks already factor in a rate cut earlier and could see performance deteriorating as it goes. It seems though we could no longer escape a possibility of a rate cut in the near term while the only question being ‘when’ and by ‘how much?’. The sentiment moving forward is getting weaker while the ringgit factor paints a bad picture for foreign holding as well.

With US climbing back to all time highs, we felt that the buying on the Malaysian end seems a little to optimistic and that is what we meant by a ‘weird optimism’ this time around. As market rebounds at this level, it really creates a dilemma especially to investors holding on to a large cash pile. Buying at the double bottom scenario pretty much proves that you got the best price and great when market goes up. The likelihood to outperform pretty much writes itself with this strategy.

But if the double bottom breaches which and that is what we believe would happen in our view, the positions bought would have under performed in the coming months. Cash holding investors who did nothing would appear like heroes who brave through the storm without actually doing anything. That is what we believe the dilemma is!

Professional investors, licensed fund managers or even sit at home retail investors, the problem is the same. Either you come out as hero or laughed at when the market recovers. Also, this problem would persist every single time the market reverses at a slower pace. The most suffering thing to happen in markets is holding on to a share and it declines bit by bit, day by day. When you face a -0.3% decrease every day for 23 trading days, that’s suffering.

Considering that the US market being at all-time high, the market has yet to see a major correction somewhat similar to the situation back in Aug-Sep this year. The possibility for that to happen seems likely as it would have done so 5 days ago merely from a bad tweet. But simply a comparison to KLCI, we are trading at year lows. Another push to the bottom for the US market could be pushing KLCI further down as well. A market doesn’t require much reason to go down as society proves to be more reactive toward elements of negativity. Factors for selling might not need to be clear and surely some would want to realize profits even though it has been reduced.

Patience seems to be the key for now. Hero or not, I think it is not the time to become one just yet. Patience will allow for the best timing and a situation where the stars might have aligned just for you.