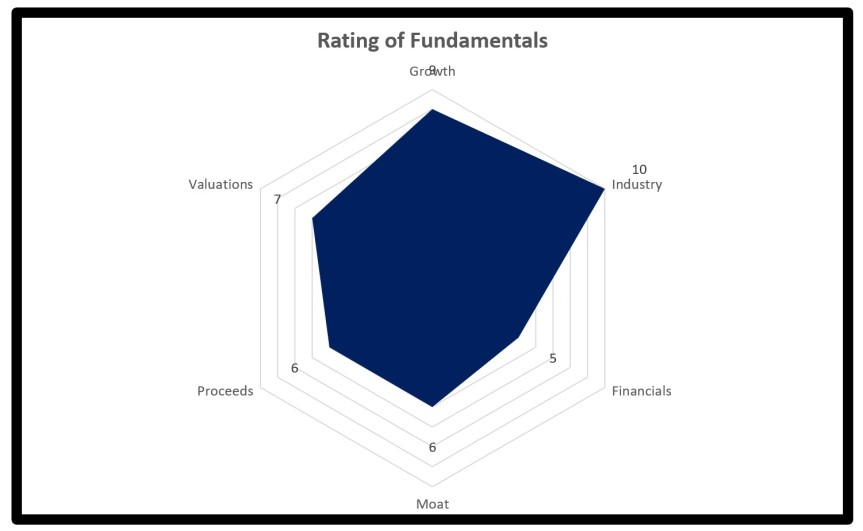

Growth 9/10

It is very obvious that we rated growth at the peak of 9 we could have rated it full if they are the market leader in digital security. It is pretty obvious that the awareness towards digital security had been alleviated after the biggest firms in the world had data breaches. We do not see a slowdown in the demand for security in this case.

Industry 10/10

Similar to the explanation on growth, the industry is currently experiencing a boom in the demand for digital security. We could have rated this criteria a full 10 with the respect to the industry and not this company in particular.

Financials 5/10

We are split on the financials due to the latest Apr 2018 report which recorded a loss. We are unsure on what is going on but the margins created from the last 4 quarters are still at double digits 17%.

We expect that due to the nature of business for this company, we would likely see a bulk load of volatility on the earnings that would be reported.

Although the debt isn’t huge at only RM 2.3 million (9% debt to equity), we are cautious with the high level of payable in the liability segment.

A back testing on our end with the cash conversion cycle calculator showed that the payable are 21 days behind which we felt that the high level of payable are still acceptable.

Moat 6/10

It could be disrupted with a bigger company coming into play. But at the moment, we still see a good moat in the company’s very own proprietary system.

Proceeds 6/10

Not the best proceeds we’ve seen so far and nothing to complain about.

Valuations 7/10

Although valuations remained cheap at the current moment, bear in mind that we are unsure why the latest quarter sees a losses. If you attribute the latest losses to the addition of the newly introduced financing cost, then we look at this as a short-term problem.

Conclusion

Although we recommend this counter as the prospects are quite good. We urge our followers not to go all out this time around. Obvious matters such as the current markets being very volatile with the recent US sell-off.

The lucky part is that the listing price is low and it should attract plenty of retail for a high chance of over-subscription. Our final advice, take up the IPO within the risk that you can handle.

The link below extracts important information from the prospectus!